- Customer Lifetime Value (CLV) is derived from margin, discount rate, and retention.

- Retention is estimated from both historical pattern and future purchase intent.

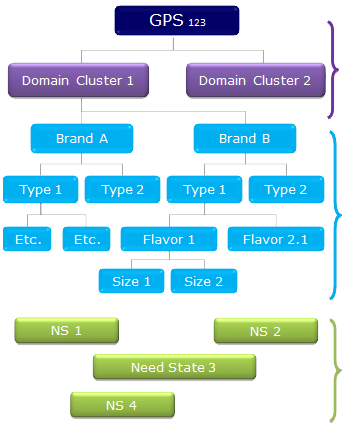

We identify the relationship pyramid status that each customer establishes with your company

- We developed a relationship scoring that properly places each customer to a dominant relationship segment – partnership (commitment-driven), family/friends (trust-driven), practical relationship (leadership-driven), and causal relationship (satisfaction-driven).

- Relationship scoring is developed based on a variety of relationship drivers - I can’t be temped away from this brand, I trust this brand, this brand rewards me for my business, this brand is a market leader, I buy this brand because it’s less expensive, I keep my eyes open for other alternatives, etc.

We connect CLV and relationship status with a common measure – retention

- Establish a predictive link between retention and relationship drivers using multinomial logit model.

- Changes in relationship drivers lead to improvement in both relationship and CLV.

- Different strategic options can be implemented for different combinations of relationship status and CLV.

We further identify the role of functional satisfaction (quality, service, ease, etc.,) in the relationship pyramid. Please contact us for further information.